How To Get A Grant To Buy A Home In Louisiana

I've got some exciting news that could change your life—free money to buy a house is not just a dream; it's a reality, especially if you're in Louisiana or planning to make it your home sweet home. My focus area is NWLA but this applies for the whole state and I can help you with a grant to buy a home no matter where you are in the state. Let's dive into it...

The Roadblock to Home-ownership

You've got a steady income, you pay your bills on time, and your credit is decent. But what about that hefty down payment and closing costs? That's where I come in with the solution. Stick around, and I'll tell you how you can get down payment assistance and possibly make that dream of homeownership a reality.

The Benefits of Down Payment Assistance Grants

Eligible buyers can receive up to 4% towards their down payment and closing costs. Let's break it down. If you're eyeing a $200,000 home, a typical mortgage with an FHA loan usually requires a 3.5% down payment— that's $7,000. But with the down payment program, you could get $8,000, covering the entire down payment with a little extra for closing costs. Negotiate well, and you might even have the seller help with remaining closing costs. Plus, you'll enjoy a lower interest rate.

The Numbers Game: Smart Financial Strategy

Sure, you'll still need some cash during the process for inspections and appraisals, (I'd anticipate at least $1,000) but compare that to the upfront costs of renting—first month's rent, security deposit, pet deposit, and application fees—and you're coming out on top.

Who is Eligible for Down Payment Assistance Grants to Buy a Home?

To qualify, you need to show proof of income for the past two years and have a minimum credit score of 640. If your household is two or less, the maximum income limit is $75,600, and for larger households of three or more, the cap goes up to $86,648. The catch? Be considered a first-time home buyer, meaning you haven't owned a home in the last three years (special exceptions exist in situations of recent divorce).

Seize the Opportunity!

Owning a home with no money down is more than just a financial strategy; it's a lifeline. It's a real opportunity to have a roof over your head, something to be proud of, and to start building wealth. And I'm here to guide you every step of the way.

Ready to Take the Next Step and Get Your Down Payment Assistance Grant to Buy a Home?

Click one of the following links. If you have questions or want to chat, hit up at the "Ask Me Anything" link. If you're ready to jump into the exciting world of home-ownership, go here "Get Pre-Qualified." We'll be in touch shortly.

Remember, your home-ownership dreams are within reach, and I've got the keys. I'm Melanie, and I can't wait to welcome you home.

The Roadblock to Home-ownership

You've got a steady income, you pay your bills on time, and your credit is decent. But what about that hefty down payment and closing costs? That's where I come in with the solution. Stick around, and I'll tell you how you can get down payment assistance and possibly make that dream of homeownership a reality.

The Benefits of Down Payment Assistance Grants

Eligible buyers can receive up to 4% towards their down payment and closing costs. Let's break it down. If you're eyeing a $200,000 home, a typical mortgage with an FHA loan usually requires a 3.5% down payment— that's $7,000. But with the down payment program, you could get $8,000, covering the entire down payment with a little extra for closing costs. Negotiate well, and you might even have the seller help with remaining closing costs. Plus, you'll enjoy a lower interest rate.

The Numbers Game: Smart Financial Strategy

Sure, you'll still need some cash during the process for inspections and appraisals, (I'd anticipate at least $1,000) but compare that to the upfront costs of renting—first month's rent, security deposit, pet deposit, and application fees—and you're coming out on top.

Who is Eligible for Down Payment Assistance Grants to Buy a Home?

To qualify, you need to show proof of income for the past two years and have a minimum credit score of 640. If your household is two or less, the maximum income limit is $75,600, and for larger households of three or more, the cap goes up to $86,648. The catch? Be considered a first-time home buyer, meaning you haven't owned a home in the last three years (special exceptions exist in situations of recent divorce).

Seize the Opportunity!

Owning a home with no money down is more than just a financial strategy; it's a lifeline. It's a real opportunity to have a roof over your head, something to be proud of, and to start building wealth. And I'm here to guide you every step of the way.

Ready to Take the Next Step and Get Your Down Payment Assistance Grant to Buy a Home?

Click one of the following links. If you have questions or want to chat, hit up at the "Ask Me Anything" link. If you're ready to jump into the exciting world of home-ownership, go here "Get Pre-Qualified." We'll be in touch shortly.

Remember, your home-ownership dreams are within reach, and I've got the keys. I'm Melanie, and I can't wait to welcome you home.

Categories

Recent Posts

Is For Sale By Owner A Good Idea in Shreveport Louisiana?

Buying A House: What is Pre-qualification?

Choosing the Right Mortgage Lender: A Local Perspective

How To Get A Grant To Buy A Home In Louisiana

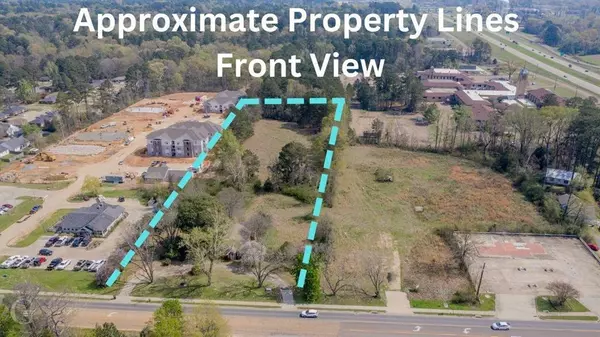

Prime Commercial Opportunity: 1322 Cooktown Road, Ruston, LA 71270

Country Place Subdivision - Haughton Louisiana

Buy Now or Wait for Lower Interest Rates? Let's Break it Down!

Vegan Food Options in Shreveport & Bossier

Things To Do In Shreveport Bossier Day Or Night

GET MORE INFORMATION

Melanie VanBuskirk

Agent | License ID: 995697161

717 Crockett St Suite 201 Shreveport LA 71101, Shreveport, 71101